- The influencer behind the viral “Hawk Tuah Girl” meme is under fire after her $HAWK coin hit a $490M valuation, then abruptly plunged by more than 90%.

- Blockchain data suggests insiders may have engineered a swift sell-off, prompting accusations of market manipulation.

- Despite the backlash, the influencer denies any wrongdoing, insisting the memecoin’s intent was fan engagement alone.

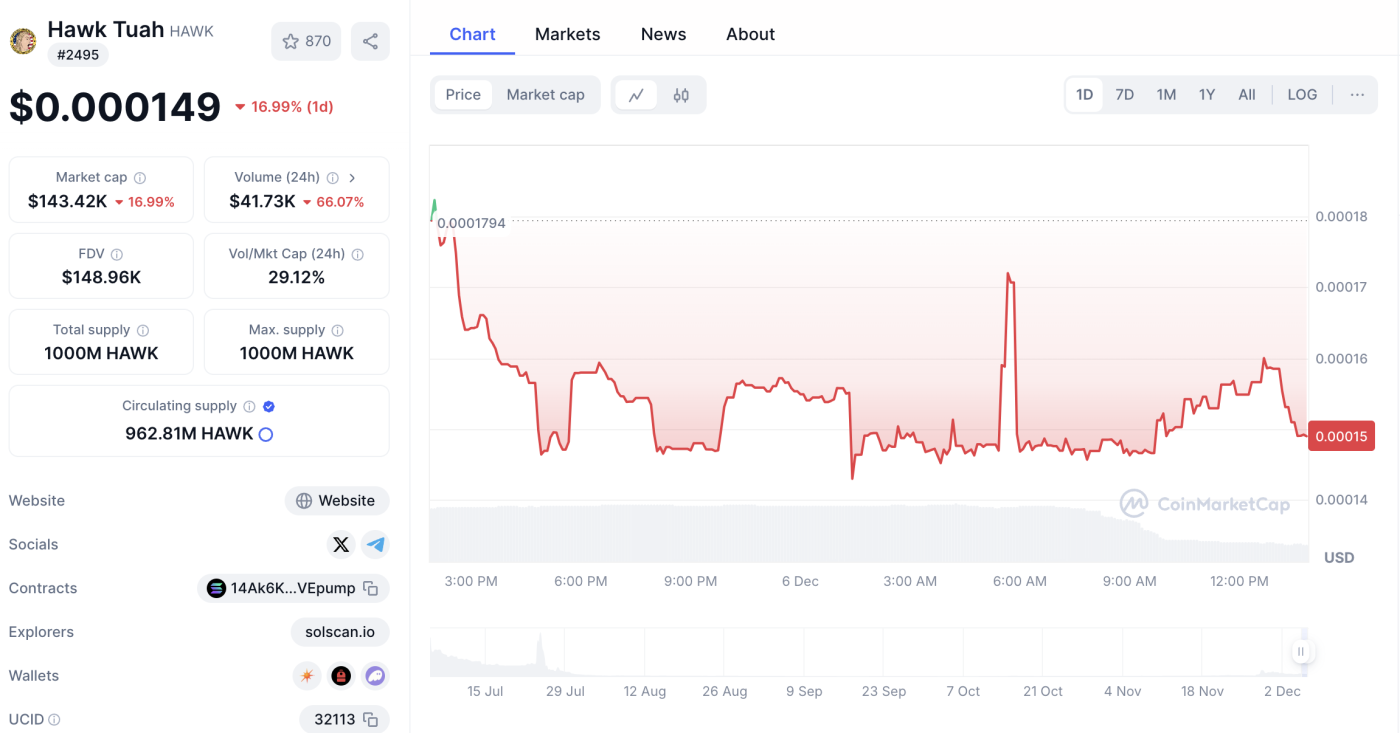

Remember Haliey Welch? The internet sensation behind the viral “Hawk Tuah Girl” meme has found herself in hot water after the disastrous launch of her meme coin, $HAWK. The cryptocurrency surged to a staggering $490 million market cap in just a few hours, only to crash by over 90%, leaving investors fuming and Welch accused of orchestrating a “pump-and-dump” scheme.

From Hawk Tuah Meme Stardom to Crypto Chaos

Welch, 22, skyrocketed to fame with her infectious viral content and sought to capitalise on her popularity by diving into the booming memecoin trend. Memecoins, like Dogecoin and Shiba Inu, are cryptocurrencies inspired by internet culture and memes. While they often start as jokes, they’ve turned into lucrative ventures for some – but Welch’s attempt didn’t have the fairy-tale ending she might have hoped for.

$HAWK launched on the Solana blockchain with an initial price of $0.005492 and quickly soared over 900%, reaching a peak valuation of $490 million. However, it all came crashing down within hours, with the coin plummeting to a $60 million market cap, a 91% drop.

Welsh has Been Accused of Insider Trading

The rapid decline of $HAWK has drawn scrutiny from investors and blockchain analysts. According to data from Solscanner, insiders and “snipers” – traders who rapidly buy up large quantities of a new token at launch – controlled an estimated 80-90% of the coin’s supply. One wallet, in particular, purchased 17.5% of the total supply for $993,000 and sold it just 90 minutes later for $1.3 million, profiting at the expense of ordinary investors. Let’s see if the SEC has a look into this.

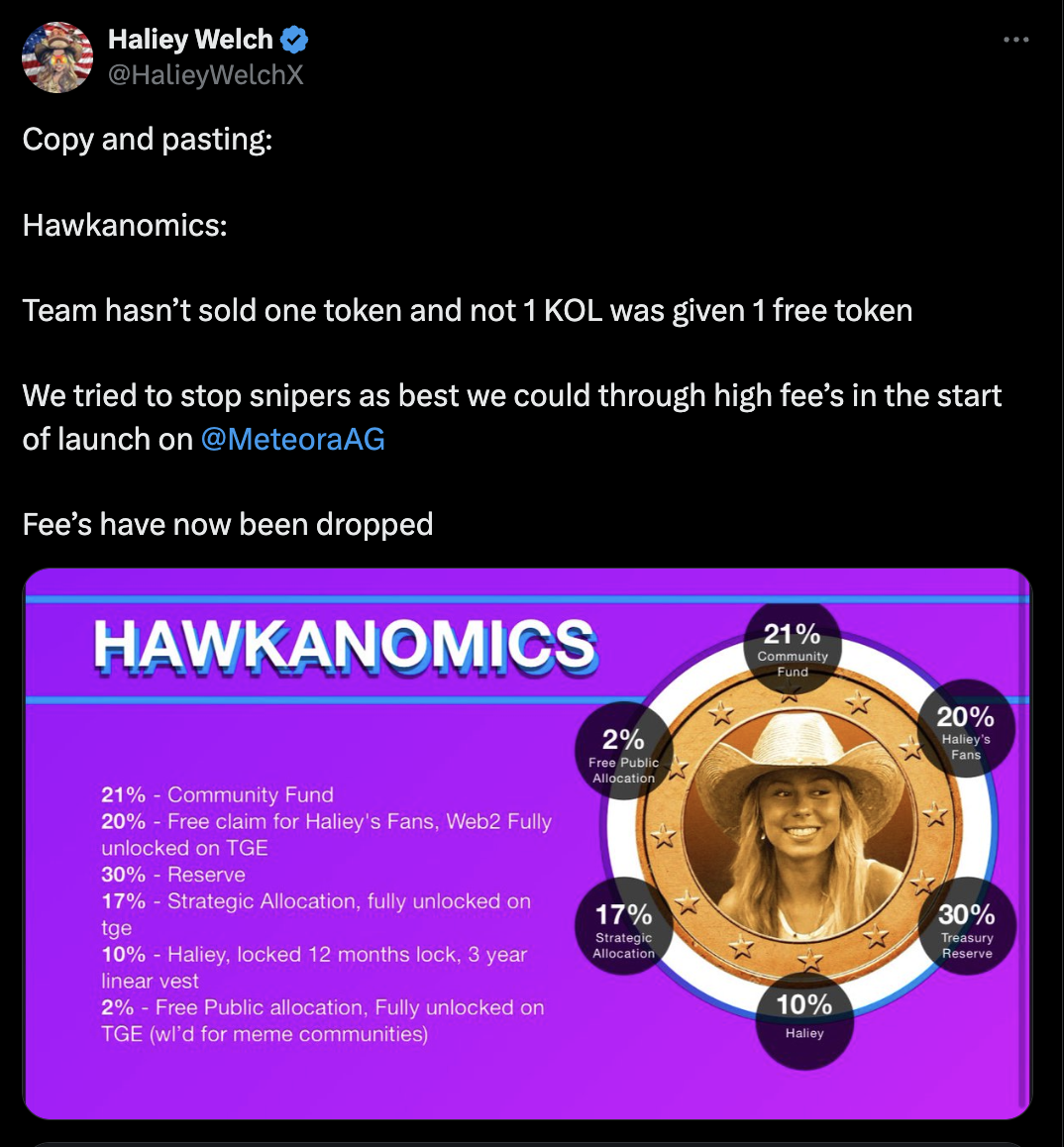

Welch has vehemently denied any wrongdoing. In a statement posted on X (formerly Twitter), she insisted her team hadn’t sold a single token and took measures to deter snipers by imposing high transaction fees at launch. “We tried to stop snipers as best we could,” she wrote. “Fees have now been dropped.”

Her manager, Jonnie Forster, told Fortune that Welch owns 10% of $HAWK’s supply, but it is locked for a year to prevent immediate sales. Welch defended the project as a “fun way to get my fans to interact” and denied any intentions of cash-grabbing.

Crypto Community is Outraged

Despite Welch’s assurances, social media has been awash with criticism. Many accused the influencer of naivety or, worse, outright scamming her fans. Golf influencer Paige Spiranac chimed in with a cheeky jab, posting, “If I’ve learned anything, it’s to never release a memecoin.”

Blockchain analysis site Bubblemaps highlighted the suspiciously concentrated ownership of $HAWK tokens, further fuelling speculation of insider trading. Welch’s team has maintained that no free tokens were distributed to key opinion leaders (KOLs) and that their allocation remains locked. Fishy.

How Likely is it that Welch Will Be Prosecuted?

It’s a meme coin; what the hell would you or anyone in the same boat expect? We’re in the midst of the third hype cycle of cryptocurrency, so it’s no wonder people thought investing in yet another meme coin was a good idea.

Have you not learned anything from the past 6 years of pump and dump cycles? Given what happened with the FTX scandal, the FBI will happily arrest anyone taking the mick when it comes to crypto fraud. The $HAWK debacle underscores the risks inherent in the memecoin market, where hype often eclipses fundamentals. It also serves as a cautionary tale for influencers venturing into the volatile world of cryptocurrency.

Our advice? It’s low, so buy, buy, buy before it’s gone gone gone. Jokes!