- Watch enthusiasts are turning to the secondary market for discontinued or hard-to-find pieces.

- Brands like Hermès are seeing significant growth in the secondary market.

- Unique designs and exclusive models that resonate more with collectors.

Luxury timepieces like Rolex, Patek Philippe and Audemars Piguet will always dominate the conversation; these three titans boast centuries-long histories that position them as the heavy hitters in haute horlogerie.

But as waiting lists for top brands are measured in years rather than weeks and exclusivity becomes the common lexicon of the day, more and more watch enthusiasts are taking to the secondary market to get their hands on their favourite pieces… and over the last five years, there has been a growing movement of lesser-known brands thriving in their place.

In watch collecting, the distinction between new and pre-owned markets can be crucial. Finding your preferred brand and model on the new market will usually take you through the official channels of in-store boutiques of the brands or authorised retailers, often with waiting lists for popular models exceeding 12-18 months.

Secondary markets, however, add another layer of value and allure as discontinued or limited-edition pieces find their place amongst other releases to become highly sought-after iterations. Of course, there will always be a place for brands like Rolex, although growth has slowly plateaued in recent months.

Related Stories

| Brand | 2020 | 2021 | 2022 | 2023 | 2024 | Delta 2024 vs. 2023 |

|---|---|---|---|---|---|---|

| Hermès | 0.08% | 0.08% | 0.07% | 0.09% | 0.14% | 62.92% |

| Piaget | 0.19% | 0.16% | 0.18% | 0.24% | 0.35% | 47.12% |

| Doxa | 0.05% | 0.04% | 0.04% | 0.05% | 0.07% | 40.86% |

| Universal Genève | 0.13% | 0.09% | 0.08% | 0.10% | 0.14% | 39.79% |

| Longines | 0.70% | 0.61% | 0.58% | 0.74% | 0.93% | 25.47% |

| Cartier | 3.00% | 3.01% | 3.13% | 4.00% | 4.89% | 22.28% |

| Grand Seiko | 0.11% | 0.25% | 0.64% | 1.30% | 1.56% | 19.97% |

| Parmigiani Fleurier | 0.09% | 0.18% | 0.18% | 0.21% | 0.26% | 18.94% |

| Citizen | 0.18% | 0.17% | 0.22% | 0.30% | 0.35% | 18.35% |

| Vacheron Constantin | 1.08% | 1.32% | 1.49% | 1.50% | 1.71% | 14.09% |

| H.Moser & Cie. | 0.16% | 0.16% | 0.17% | 0.20% | 0.22% | 12.35% |

| Tudor | 2.34% | 2.22% | 2.41% | 2.68% | 2.94% | 10.01% |

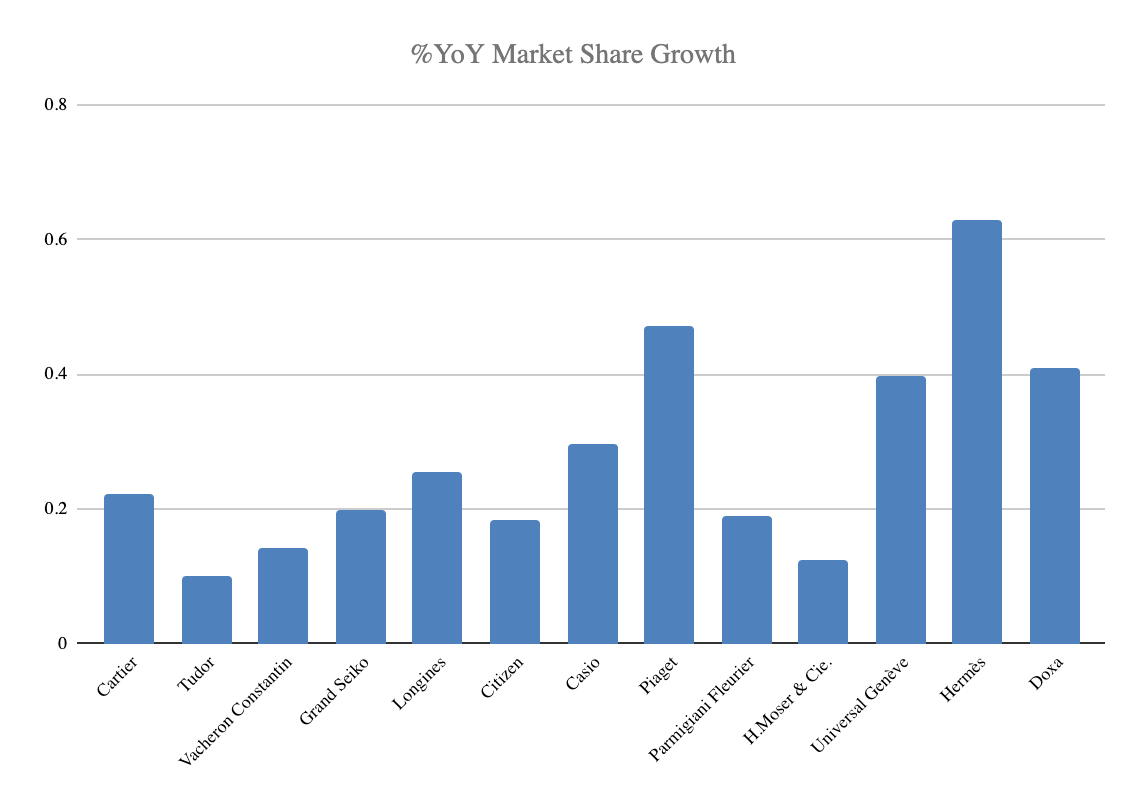

According to recent data from Chrono24, other big names like Cartier and Vacheron Constantin, for instance, have surged in value with particular models, while brands like Tudor, which has finally started to step out of its big sister’s shadow, have carved out a strong presence on the grey market with consistently high resale value… but there’s one brand in particular that has enjoyed to remarkable run.

Known primarily for its origins as a luxury bag maker in Paris, Hermès has seen the highest year-on-year market share growth on Chrono24. The French brand made a respectable transition into the watch game with a timeless avant-garde style that has become one of the hallmarks of this highly-sought-after Maison, debuting stellar releases to critical acclaim at the annual Watches & Wonders event in Geneva this year.

Of course, Hermès began its watch journey in the 1920s but truly made waves in the 2000s with the launch of its in-house movements, introducing iconic pieces like the H08, Cape Cod and the Arceau, that have found new life in the secondary market, drawing the attention of buyers looking for exclusive releases.

Elsewhere, Piaget is the next biggest watch brand on the rise, enjoying a 47.12% jump from 2023 on Chrono24. Famed for its ultra-thin movements and refined designs, Piaget’s position in haute horlogerie has helped it thrive on the secondary market with celebrated releases like the Altiplano and Polo S collections which appeal to buyers looking for dress watches that combine sleek elegance with robust craftsmanship. The Polo

We’re not entirely surprised; Piaget has enjoyed a huge year, gracing the wrists of Hollywood stars like Adam Driver on the Megalopolis red carpet, and similarly, turning heads with one of watchmaking’s most challenging complications, debuted at Watches & Wonders this year: the Piaget Altiplano Concept Tourbillon. The Polo 79 also won big at this year’s Le Grand Prix d’Horlogerie de Genève.

Rounding out the Top 3 is a lesser-known independent Swiss manufacture that specialises in producing dive watches of the highest quality. Established in 1889, Doxa is best known for its unique cushion-shaped cases, remarkable durability, and, of course, iconic bright-orange dials.

Originally made famous by divers and explorers, the brand earned a place in diving history by launching the Sub 300, one of the first watches designed specifically for professional divers, developed in collaboration with diving legend Jacques Cousteau. These days, Doxa releases boast some of the best water-resistance available on the market today – upwards of 1,200 metres – making this Swiss brand’s releases trend-resistant, with a decent return on the secondary market.

Narrowly missing out on the podium is Universal Genève, a vintage favourite that has become synonymous with historical chronographs and intricate designs throughout its revered history. Today, its legendary “Microtor” movement, a pioneering ultra-thin design that housed the winding rotor within the movement itself, still attracts watch enthusiasts and collectors on the secondary market looking to acquire a piece of horological history.

In a nostalgic nod to its roots, the Swiss icon has recently reintroduced the iconic Polerouter collection, celebrating 70 years since the legendary Scandinavian Airlines polar flight. Originally crafted by a young Gérald Genta in 1954, the Polerouter was no ordinary watch; it was designed to help SAS pilots tackle the gruelling conditions of transpolar routes with a shock-resistant case, anti-magnetic movement, and moisture-proofing.

As the secondary market continues to evolve, lesser-known brands are proving they have more than just a place alongside the big names. Whether it’s the distinctive designs of Hermès, the masterful movements of Piaget, or the timeless innovation of Universal Genève, there’s an undeniable shift happening that is driving the conversation away from the traditional titans of industry, introducing watch enthusiasts with exciting releases that continue to redefine the luxury market.